INNOVATIVE CONCRETE SOLUTIONS FOR EMERGING ASIA

Manuel Furer

Holcim, Regional Director Concrete & Aggregates, 3A International Business Park, Icon @ IBP, Singapore 609935

Abstract

Population growth and urbanization will continue to globally drive growth in construction and the demand for construction materials, including cement and concrete. Emerging Asia is a key driver of construction growth, and Asia is rapidly becoming the largest construction market, with an estimated share of 46% of the total global construction spend by 2020. Four key trends in Asia’s construction industry are the need to improve productivity in construction, the construction of even taller buildings, the need to build and repair road infrastructure fast and issues related to availability and quality of the sand used for concrete. Innovative concrete solutions which address these trends are self-levelling concrete, high-strength and light-weight concrete, ultra-fast road repair solutions using fast-setting and fast-hardening concrete and high-performance manufactured sand.

These innovative concrete solutions have been developed, tested-bedded and are being used in various markets in emerging Asia. They are examples of how the concrete and aggregate industry can meaningfully address rapidly changing construction needs and add value to industry and society at large. A close cooperation between the concrete, aggregate and construction industry as well as other stakeholders such as government entities and academic institutions is required to promote innovation in concrete. One such platform enabling cross-stakeholder cooperation is the Centre of Excellence in Singapore, a concrete development centre jointly funded by Holcim and the Government of Singapore.

EMERGING ASIA WILL CONTINUE TO DRIVE GLOBAL CONSTRUCTION GROWTH

Population growth and progressing urbanization will continue to globally drive growth in construction and the demand for construction materials, including cement and concrete. It is expected that construction will globally rise over 70% (USD 6.3 trillion to USD 15 trillion) by 2025 (compared to USD 8.7 trillion in 2012) and that in the future over 60% of global construction activity will be undertaken in emerging markets [1].

Emerging Asia is a key driver of construction growth, and Asia is rapidly becoming the largest construction market, with an estimated share of 46% of total construction spend by 2020 [2].

RAPIDLY CHANGING CONSTRUCTION NEEDS IN EMERGING ASIA REQUIRE INNOVATIVE CONCRETE AND AGGREGATES SOLUTIONS

Four key trends in emerging Asia's construction industry are discussed in this paper:

- Need to improve productivity in construction

- Construction of even taller high-rise buildings

- Need to build and repair infrastructure fast

- Unsustainable use of natural construction sand and manufactured sand as an alternative Innovative concrete solutions which address some of these needs are:

- self-levelling and high-flow concrete;

- lightweight concrete;

- ultra-fast road repair solutions using fast-setting and fast-hardening concrete; and

- high-performance manufactured sand.

These innovative concrete solutions are being used in several markets in emerging Asia already, but they clearly have a lot more potential. They are good examples of how the concrete industry as a key player in the construction value chain can meaningfully address market and societal needs and add value in a rapidly changing market place. Close collaboration by the concrete industry with other stakeholders in the construction industry, with government bodies and with academic institutions is a prerequisite for many innovative concrete solutions to gain traction.

PRODUCTIVITY: SELF-LEVELLING CONCRETE

Table 1:Comparison of a contractor measuring construction productivity benefits using self-levelling concrete in Singapore

Real-life studies in Singapore have shown significant improvements in construction productivity with improved speed of construction of up to 30% and manpower savings of up to 50% when using self-levelling concrete compared with conventional concrete. Additional benefits of self-levelling concrete are less noise, a safer work environment as fewer workers are required to place and vibrate the placed concrete, less defects and honeycombing in congested re-bar areas and a generally better finish.

Due to its relatively lower content of cementitious materials, self-levelling concrete does not suffer from some of the disadvantages and negative side effects of traditional self-compacting concrete. Self-levelling concrete has proven to be commercially attractive and has been successfully launched in a number of markets in emerging Asia, with the biggest off-take in Singapore where the government proactively drives and incentivizes improved construction productivity. Other markets in emerging Asia are also taking up the self-levelling concrete concept due to the increasing pressure on developers and contractors to speed up construction (better returns on capital) and, in some cases, due to severe shortages of (skilled) construction labour and increased community pressures to reduce noise emissions. More complex designs of concrete structures also drives demand for self-levelling concrete.

Self-levelling concrete needs to be carefully formulated and tested in each market due to locally varying raw materials. Developers, specifiers and contractors all need to be made aware of the existence and benefits of self-levelling concrete. The benefits of self-levelling concrete need to be included early in the detailed construction planning process by contractors to reap full productivity benefits. Potential objections due to negative perceptions of traditional self-compacting concrete need to be openly discussed.

HIGH RISE CONSTRUCTION: LIGHTWEIGHT CONCRETE

Emerging Asia sees an unprecedented urbanization and, associated with it, a boom in the construction of high-rise buildings. Lightweight concrete with densities as low as 800 kg/m3 have many advantages in the context of high-rise structures, some of which are:

- reduction in foundation loads;

- reduced dead loads;

- improved thermal insulation; and

- improved acoustics.

A significant improvement in the physical properties of a building and cost savings can be achieved by using lightweight concrete in high-rise buildings. Other applications of lightweight concrete are floating structures and topping of existing floors.

Fig. 2: Lightweight concrete floating in water, displayed at Holcim Singapore’s Centre of Excellence

Fig. 3: Lightweight concrete used to build a floating structure on Singapore’s Marina Bay

Light-weight concrete can be used for structural applications with strengths of 30MPa or higher. It comes either as air-based concrete or with lightweight aggregates such as Mesalite, expanded clay aggregates or fly-ash based aggregates.

The key challenge when specifying, producing and placing lightweight concrete is for the designer, the contractor and the concrete producer to fully understand its physical and mechanical properties and its limitations. Careful selection and quality control of raw materials, a tightly controlled concrete production process and relevant precautions when delivering, pumping and placing lightweight concrete are important. An early and close cooperation between all stakeholders in the construction value chain is required to increase the usage of lightweight concrete for high-rise buildings and for other structures.

FAST ROAD REPAIRS: FAST-SETTING AND FAST-HARDENING CONCRETE

The roads and other infrastructure in many of emerging Asia's mega-cities are notoriously overused and clogged. Ageing road infrastructure, overusage and heavy monsoon rainfall in many parts of emerging Asia lead to an increased need for the repair of roads. However, the cost to road operators and to society by closing roads for repair for days or weeks is significant.

Fig. 4: Typical road conditions in a mega-city in emerging Asia

Fig. 5: Innovative concrete solutions addressing the need for ultra-fast road repairs

This led to the innovative development of an integrated, fast-track road repair solution, which was piloted in Jakarta and is also now used in other Asian cities such as Bangkok and Mumbai. This road repair solution is an end-to-end service using an ultra-fast setting and hardening concrete which allows retrafficking of repaired road stretches in as little as four hours from the start of the repair job. This is a significant reduction in repair lead times from the days or weeks it traditionally takes to repair a patch of road with concrete. The concrete used in this solution is a specially developed mix with multiple binders some of them specifically developed for the application a set of admixtures as well as top-quality fine and coarse aggregates. The entire process of breaking the road, delivering and laying the concrete must be carefully timed and orchestrated.

As a result, the cost per m3 of concrete or per m2 of road repaired with such fast-track road repair solutions is significantly higher than for conventional repair methods. However, considering the time gained from the accelerated road repair, fast-track road repair solutions bring huge value for the road operators as well as the for the road users, i.e. society at large.

Close and early-stage interaction and communication between road authorities, specifiers, road operators and the fast-track road repair solution provider are required to reap the benefits of the solution. It is encouraging to see very open-minded and innovative road authorities and road operators, such as the ones in Jakarta, recognize the value of fast-track road repair solutions.

NATURAL SAND SHORTAGE: MANUFACTURED SAND

In many emerging Asia markets, natural sand used for concrete production is exploited unsustainably. This led the authorities in several markets to crack down on environmentally damaging sand exploitation which in some cases led to the ban of the exploitation of natural sand. Given the buoyant construction growth and the continued increase in the consumption of concrete, shortages of natural sand in emerging Asia pose a huge challenge for the concrete industry.

Fig. 6: Emerging Asia faces significant issues with unsustainable exploitation of natural sand

Manufactured sand, or M-sand, is the logical alternative fine aggregate that is already widely used to replace natural sand partly or fully. Concrete in Singapore or Mumbai, for example, is already produced with 100% M-sand replacement of the fine aggregates fraction. However, many misperceptions exist regarding the physical properties of M-sand and its suitability to produce and perform in concrete. In a number of cases, natural sand is specified, although properly produced M-sand could do the job just fine. Despite its increasingly important role as a sustainable alternative to natural sand, M-sand has a relatively poor reputation in many markets. The key problem most concrete producers face with M-sand is that lowvalue quarry by-products are often sold as M-sand. This leads to quality fluctuations and performance issues in concrete.

Fig. 7: Manufactured sand is a sustainable alternative to natural sand for concrete production.

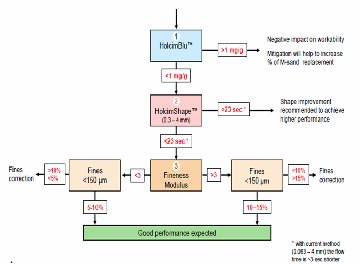

As a first and crucial step to improve its performance in a targeted and meaningful manner, M-sand specific performance parameters such as deleterious clay content and shape must be tested and studied, in addition to standard sand testing methods. If such M-sand specific tests and studies are not performed, Msand performance issues cannot be addressed correctly, leading to sub-optimized concrete mixes and ultimately to commercially unattractive M-Sand concrete mixes. For example, having a high level (>10%) of fines <125μm is often considered undesirable and confused with the issue of having deleterious clays present in an M-sand. Instead of addressing the deleterious clay issue at source or in the M-sand production process, M-sand is often washed, getting rid of the deleterious clays but also depleting fines which could have acted as lubricants, leading to a relatively poorer workability performance and to harsh concrete mixes .

|

Fig. 8: Manufactured sand’s specific performance parameters need to be more consistently measured and better understood.

Standardized M-sand methylene blue tests, sand flow tests and easy-to-use mortar flow tests as well as calibration curves have been developed to test M-sand specific properties, namely deleterious clay content, particle shape and mortar flow as a proxy for concrete slump or flow. Along with these testing tools, a decision tree with limit values has been developed which recommends specific, corrective actions to be taken regarding out-of-spec M-sand performance parameters. For all of the above to be successful and for M-sand to get the recognition that it deserves as a sustainable sand alternative, a close interaction between concrete producers, aggregate producers and specifiers is required to ensure that M-sand is optimally assessed, produced and used.

CONCLUSIONS

Emerging Asia offers tremendous market potential for the concrete and aggregates industry. Asia’s (mega-) cities and their associated infrastructure needs are shaping the needs of the construction industry at a fast pace. Construction productivity, construction speed and the use of more sustainable construction materials are rapidly emerging needs, and the concrete industry plays a pivotal role in addressing these needs.

For the development and meaningful commercialization of innovative and value-added solutions such as the ones outlined in this paper, a close collaboration of the concrete and aggregate industry with the construction industry at large and with other stakeholders such as government entities and academic institutions is required. Platforms such as the Centre of Excellence in Singapore, a concrete development centre jointly funded by Holcim and the Government of Singapore, play an important role in driving innovation in concrete.

Fig. 9: Joint concrete R&D platforms such as Holcim's Centre of Excellence in Singapore connecting all the construction stakeholders concerned

REFERENCES

- Global Construction 2025

- AECOM, Asia Construction Outlook 2013